It seems most people today only hear about Medicare Advantage. Few know about MediGap or supplements. Why? Medicare Advantage has become very popular for many reasons:

- Cost

- Ancillary benefits (dental, vision and hearing)

- Part-B premium givebacks (depending on the plan)

- Other cost-saving benefits like over-the-counter allowances, gym memberships, food cards, etc.

…to name a few. The fact that the television is inundated with commercials for a variety of Part-C plans, it would make one think it’s the only option. But there are two options:

- Original Medicare with a MediGap policy (Medicare Supplement)

- Medicare Advantage

The question is which one is better? The answer, depends. Let’s take a look.

MediGap Policies

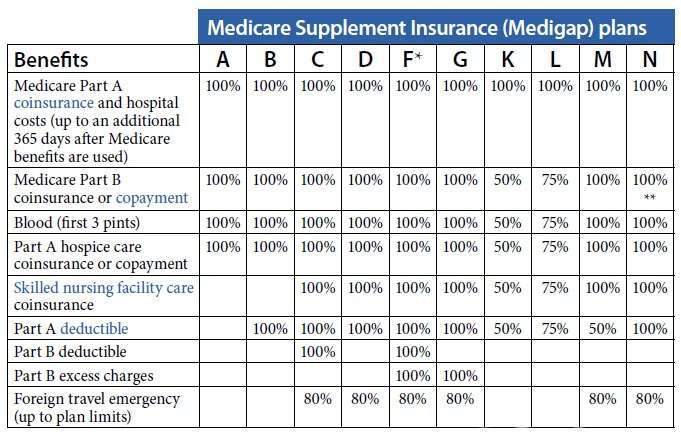

MediGap policies used to be the predominant way people took their Medicare benefits. They were designed to fill the gap (hence MediGap) that Medicare left unfilled, which could be very costly, since there is no maximum-out-of-pocket limit with Original Medicare. This included deductibles, copays and coinsurances.

Many different kinds were created, but the most popular was the F plan, because it covered everything. However, anyone becoming eligible for Medicare after 2020 can no longer buy an F plan; only beneficiaries with an eligibility of 2019 and prior may purchase one. Hence the G plan became the most popular. What’s the difference? The G plan covers everything except the Part-B annual deductible, which as of this writing is $203 (2021).

What Do MediGap Plans Cost?

A G plan at 65 (when you have guaranteed issue at preferred rates), costs on average $200 per month in 2021, depending on the carrier. After 65 or your ICEP (initial coverage enrollment period) medical underwriting is used to determine the premium. If you have certain health challenges, it can make it more costly. And many plans have a period of no coverage for certain preexisting conditions that can run from 90 days to a year.

When choosing a MediGap plan, focus on the annual increase average. Some plans increase their premium at 2% annually on average, while some may be as high as 9%, and anywhere in between. You want the lowest increase possible.

What makes a MediGap policy so good is that they are transparent to you, the beneficiary. In other words, you can go to any doctor, hospital or facility that accepts Medicare, anywhere in the United States and outlying territories, give the provider your red-white-and-blue Medicare card and you will see no bill (other than the $203 Part-B deductible if you’ve not paid it yet and are on Plan G).

Now, this kind of convenience comes at a cost, so the most important criterion is, can you afford it, long term? When you consider that you must pay:

- Your Part-B premium (which increases every year)

- Your MediGap premium (which also increases annually)

- A Part-D plan premium (can range between $15 and $50, depending on how many and what kinds of prescriptions you take, which also increases annually)

- And a dental and vision plan, since neither MediGap nor Medicare includes ancillary benefits (can range from $30 to $80 per month, depending on plan and benefits)

Which can equal over $400 a month, whether you use it or not. If you can afford it, other criteria to consider include:

- Are you a wanderer? Do you live in one location for six-months a year, which is a criterion for Medicare Advantage?

- Do you have or had chronic medical challenges and may need costly care at the best facilities available, now or someday?

You see, a facility may be in network for an insurance policy, but that does not mean all the doctors and specialists who work there accept your insurance policy. Some may, all may, or none may. Having a MediGap policy alleviates that problem.

Based on this, you may be asking yourself, “So, is MediGap the best way to go? Did I make a mistake with Medicare Advantage?” Let’s take a look and then decide which is best for you.

Medicare Advantage

When you look at all the moving parts Original Medicare with a MediGap plan has:

- Part A (hospital insurance)

- Part B (medical insurance)

- MediGap plan (Supplement)

- Part D (prescription drug insurance)

- Optional, dental and vision insurance

…it’s a lot to juggle, never mind the cost.

Medicare Advantage unites all these moving parts into one neat package and eliminates many expenses. For example: most Medicare Advantage plans include:

- Hospital and medical insurance (Parts A and B) for no deductible (but may have copays)

- Prescription drug plan with no premium, and often no deductible

- MOOPs (maximum-out-of-pocket limits) capping your expenses

- Dental, vision, hearing, chiropractic and acupuncture

- And many offer Part-B premium give backs that can range from $50 to $148 per month.

This eliminates MediGap, dental and vision, and Part-D premiums, providing a savings of approximately $300 per month (depends on plans). While you still must pay your Part-B premium, if you get a plan that gives you a Part-B giveback, it can reduce the cost by $50 to $148 dollars, bringing your monthly out-of-pocket fixed cost to anywhere from $100 to $10. Those are HUGE savings.

But what about going to any doctor or facility in the United States?

While you can’t go to just any doctor you choose, many PPO plans have a take-it-with-you feature. What this means is wherever they have a network, you can use the plan as if it were local.

Now, while that sounds great, ask yourself, “If I were traveling, would I really want to schedule a regular doctor appointment?” Answer, “No.” Most people are concerned with if they get sick or have an emergency, can they go to an urgent care center or an emergency room and be covered. Almost all Medicare Advantage plans offer emergency and urgent travel coverage. Many even offer it worldwide.

But what about if I need to see a specialist or go to a certain facility and they are not in my plan’s network?

Here you have two possibilities. First, if you have a PPO, you can step out of the network and know you won’t get stuck with the entire bill. You will have higher copays, coinsurances and/or deductibles, but you won’t foot the entire bill.

Second, you are not married to your Medicare Advantage plan. Part-C plans have no medical underwriting. While you would have to either be in AEP (annual election period, Oct. 15th through Dec. 7th), or OEP (open enrollment period, Jan 1st through Mar. 31st) to make a change, there are other conditions that can grant an SEP (special election period) that allows you to change your plan during the year.

Since there’s no underwriting, you need not fear they will turn you away because of a preexisting condition, or that you will pay more than the healthiest beneficiary on that plan. No discrimination whatsoever! Change your plan to one that includes where you need to go, and once effective (typically the first day of the next month), you may go see the doctor or facility.

But what about all those copays and coinsurances?

While there are copays and coinsurances, consider this. If you are saving approximately $3,600 a year, there’s your copay money. Keep in mind that with MediGap you were spending $3,600 a year as a fixed expense, regardless of whether you needed medical attention (sort of like prepaying your healthcare). With a Medicare Advantage plan, you only pay a copay or coinsurance if you actually go to the doctor (pay as you go). Ask yourself, “How often do I go to the doctor on an annualized basis?” Add those visits up, multiply them by the copays and see what your cost would be.

Let’s use an example of 4 PCP visits, 8 specialist visits, one emergency room visit and one week in the hospital. You had a medically challenging year! Well, using hypothetical copays:

- PCP: 4 X $0 copay = $0

- Specialists: 8 X $20 = $160

- Hospital Stay: $200 per day for the first 5 days = $1,000

- Urgent care: $40

The total cost would be $1,200. Subtract it from the $3,600 you no longer pay with MediGap, and you saved $2,400 this year. If you receive a Part-B giveback, add that amount to the savings.

In conclusion

So, as you can see, it’s not a hard and fast answer. Depending on your:

- Health

- Resources

- Economic situation

- Lifestyle

The best choice for you would be the most convenient one with the highest personal return. Make sure to speak to your agent. A good agent will ask many questions to identify your needs and consider everything before recommending anything. Finally, your agent is only there to guide you. Remember it’s YOUR care, money and health. You are the final decision maker. Never let anyone pressure you into something you don’t feel comfortable with.

If you don’t have an agent, reach out to us at YourCareRep.com. We are a fiduciary, which means we do only what’s in your best interest. We contract with half-a-dozen carriers to find you the right fit. So give us a try!