The American dream is to prosper and provide a better life for our families and children than we had. That means different things for many but earning well is part of the plan. As we get closer to retirement, we want to earn as much as possible, since Social Security determines one’s monthly payment based on the final two years of earnings. But that also may mean a higher Part-B and -D premium for Medicare. However, often what we earn upon retirement is less than two years previously. Did you know you can appeal your Medicare IRMAA surcharge? Here’s how.

What Is IRMAA?

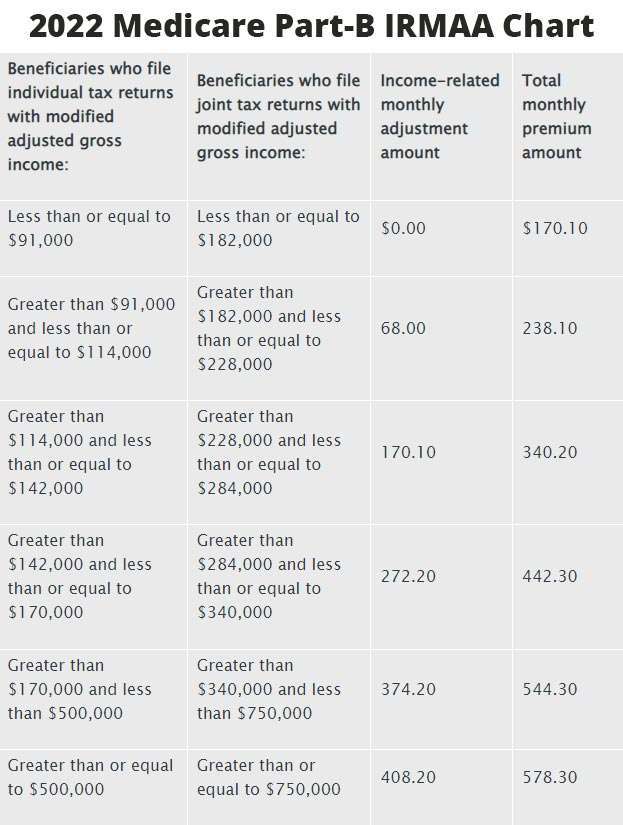

Many people aren’t aware that IRMAA exists, because only about 7% of the 63.3 million Medicare beneficiaries (4.4 million) have to pay the surcharge. IRMAA (Income Related Monthly Adjustment Amount) is a means-tested way of charging Medicare’s Part-B and Part-D premiums. The more you earn, the higher the amount. You can see the table below for 2022’s Part-B IRMAA rates.

Therefore, contrary to popular belief, $170.10 is not the only rate.

How Is IRMAA Calculated?

IRMAA is calculated on your earnings two (2) years before taking Part-B. For most people this is at 63 since they get their Part-B at 65. However, if you continue to work and choose to take Medicare at 67, for example, then it would be based on your income at 65. If you look at the chart above, look at your income tax form from two years ago, and you can anticipate what your IRMAA will be, if applicable.

Who Can Eliminate or Lower Their IRMAA?

What if you are no longer earning at that level? What if your income dropped below $182,000 if married filing a joint tax return, or $91,000 if you’re single, due to a life-changing event? Or, what if you were really blessed and fell into the second or third tier, but now are earning at a lesser tier? You will have your IRMAA assessed on income you no longer have. If this were the case for you, you could possibly reduce your IRMAA or maybe even eliminate it.

Since The Social Security Administration cannot look at your current modified adjusted gross income, they must assess the surcharge based on what information they have available to them. However, you can make them aware of your current income level and have your IRMAA reassessed. You do this by filing an appeal.

How Do I File an Appeal for IRMAA?

In order to qualify for an appeal, you must prove a life-changing event took place after the year of assessment. For example, if your assessment was made on your 2020 taxes, but:

- The pandemic devasted your business or work and you lost income.

- You lost income-producing property you owned because there were no tenants, or they were not paying their lease.

- Your spouse died and his or her income was no longer available.

- You went through a divorce, or you got married, and it affected your income.

…and the loss in income is reflected in your 2021- or 2022-income taxes, you can request a reassessment. You do this by filing the MEDICARE INCOME-RELATED MONTHLY ADJUSTMENT AMOUNT – LIFE-CHANGING EVENT form, FORM SSA-44.

In order to win your appeal, you will want to provide as much evidence as possible that supports your claim. Things to consider:

- A recent tax return that reflects the loss

- A letter from your former employer stating you retired

- Pay stubs and bank statements

- A death certificate or divorce decree

- A marriage license and documentation supporting the loss of income due to the marriage (or increase in dependents)

While your IRMAA is reassessed annually and will change based on your income and circumstances eventually, a year or two of paying a surcharge adds up to a lot of money. Why wait one or two years before it’s removed or lowered when you can have that happen now?

If you have any questions or just need help ensuring you are receiving every benefit or program you are entitled to, talk to your agent. If you don’t have one, reach out to me here at YourCareRep.com. As a fiduciary agent, I am morally and legally obligated to do only what’s in your best interest, and I’m not captured by any insurance carrier. Therefore, I am only beholden to you. Also, if you’ve not done so, subscribe to our newsletter to make sure you never miss an article full of money-saving tips and news that affect your benefits.