October 1st is only 10 days away (as of this writing) and it is time to decide whether to stay with your current Medicare Advantage (MAPD) plan or change it to something better. What will make a change viable is what your plan will become in 2026. So, let’s look at:

- Your Annual Notice of Change

- Universal changes to Original Medicare for 2026

- Whether you should use a fiduciary broker versus a captured agent

- What being a member of the YourCareRep family means for you

Your Annual Notice of Change

You will receive a letter from your insurance company informing you of any changes to your plan for next year. Also, we (YourCareRep) will be calling you to go over those changes so you can make an educated decision. If we see another plan that would be better for your unique circumstances, we will notify you and you will let us know if you wish to change.

And don’t worry if you think you may make the wrong choice; you will have an opportunity to revisit your plan during Open Enrollment, which runs January 1st through March 31st. We will be here to help you with that as well.

Changes to Medicare for 2026

While individual insurance companies (Aetna, Humana, UnitedHealthcare, Et. Al.) have their own plan changes, CMS (Medicare) will ALSO have changes that may affect you even if you regardless of plan. For example, the Part-B premium affects you whether you are on Original Medicare or a Medicare Advantage plan.

These numbers have yet to be published as final by CMS, but many reputable sources are quoting them, hence they will most likely be the final numbers. Here are the changes for 2026.

- 2026 Part-B Premium: $206.50 per month.

- Part-B Annual Deductible: $288.00

- Hospital Deductible: $1,716.00 for your first 60-day benefit period or part thereof. Remember, you only get 150 lifetime hospitalization days with Original Medicare, 90 regular and 60 reserve.

- Remainder of Regular Days, 61-90: $429/day

- Reserve Days, 91-150: $858/day

- Skilled Nursing/Rehab Daily Copay for Days 21-100: $214.50. Remember, after 3 days in the hospital, you are eligible for up to 100 days of skilled nursing. The first 20 days are at no cost; however, days 21 through 100 have a daily copay. You get 100 days lifetime with Original Medicare.

- 2026 Part-D Average Premium: $38.99 will be the average cost for a PDP plan, as set by CMS. What you purchase, if on Original Medicare, may differ depending on the plan, but this amount is used to gage any Part-D penalties.

- Part-D Deductible: $615.00

- Part-D Maximum-Out-Of-Pocket Limit: $2,100.00

- Extra Help (LIS) Cost Share: Extra Help is a federal program to help people with prescription costs if they meet certain income eligibility. If any medication has a copay (some generics do fall into tier 3) then the following would be the copays owed regardless of the plan’s copay or coinsurance.

- Generics: $5.10

- Brands: $12.65

- Deductible: $0

If you are not sure if you qualify for the Extra Help Program, reach out to us (simply click here) and we will check if you are eligible. If you are, we will help you apply at no cost to you.

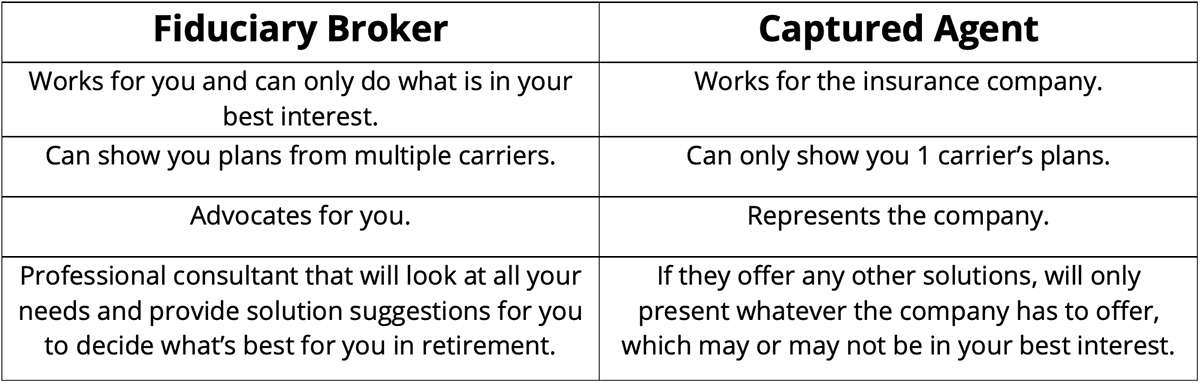

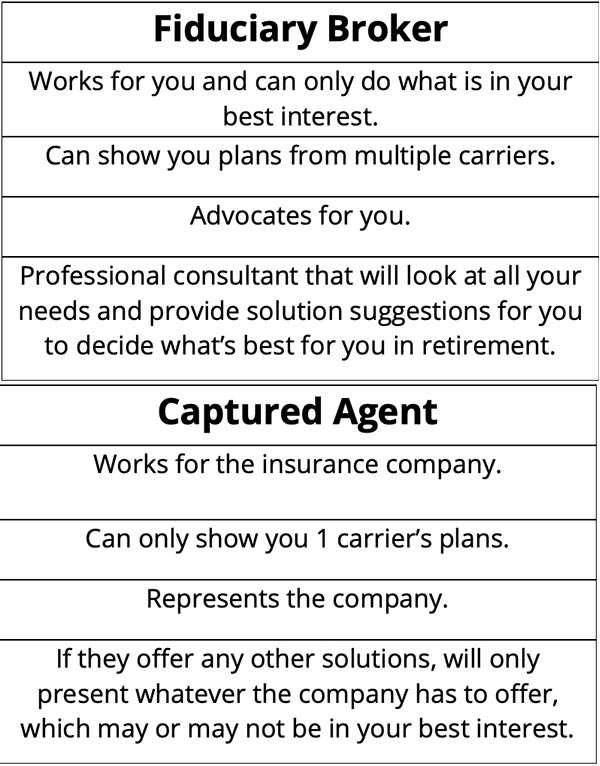

Fiduciary Broker versus Captured Agent

There are two types of agents: captured and fiduciary brokers. While both have your best interest in mind, the differences are many. Let’s look at those.

A fiduciary broker can only do what is legally, ethically and morally in your best interest, or he or she can be penalized, fined, lose his or her license, or even jailed if egregious enough. So, there are many incentives to ensure they do the right by you.

Why Being Part of YourCareRep Is the Best Choice

When you choose YourCareRep, you get an advocate. Now, many people say that, so let me count the ways.

- We are a fiduciary brokerage and represent only you.

- We contract with 11 major carriers with over 100 plans, so we are able to look for the best plan by savings and benefits, without playing favorites.

- Aetna

- CarePlus

- Devoted

- Freedom

- HealthSpring (formerly Cigna)

- Humana

- Molina

- Optimum

- Simply Health

- UnitedHealthcare

- WellCare

- We help with Medicare Supplements and/or Medicare Advantage

- We offer life insurance, final expense, fixed Indexed annuities, cancer, heart attack and stroke, and dental and vision insurance. We are a one-stop shop.

- We are an RSSATM (Registered Social Security Analyst) organization. We can guide, educate and help you with social security issues. Read the Kiplinger’s article on RSSAs, here.

- We are a member of the Better Business Bureau.

- We are available to help you and answer questions all year long. AND we actually answer the phone and call you back.

- We are veteran specialists. Our founder, Eddie Velez, is a former Marine, a member of The Marine Corps League which exists to help veterans, their widows and orphans, and is awaiting to be certified as a Veteran’s Claims Agent. We also have agents who served as well. We take veterans seriously and help them in many ways.

- We help you file appeals and grievances. If you ever need to appeal a decision with your insurance plan, we guide and help you. We don’t leave you to figure it out on your own. And according to CMS, 80% of appeals are overturned and granted.

As you can see, whatever your need, we are able to help and glad to do so.

Finally, we don’t ask you to stick your head in the ground when other agents try to convince you to change your plan (as this happens often). What we ask is that you gather the information, whether it be from a TV commercial, website, mail or email, and send it to us. Let’s discuss it! If:

- You qualify for what they promise

- It is real and not a scam

- You don’t already have it and are unaware of it

…we can get it for you. Remember, with all the carriers we contract with, chances are it’s one of those companies the telemarketer is pushing. If it is in your best interest, we will make that change for you.

So, there you have it! If you have any questions, feel free to reach out to us. Be patient knowing we will be calling you to do your Annual Notice of Change. Do not worry about anything on TV or the mail. Just keep notes and bring it up when we talk, so we can check if it is in your best interest.

Finally, please share this information with your friends and family. Help them have peace of mind knowing they are working with a reputable company who actually has THEIR BEST INTEREST in mind. Then sit back and start enjoying your retirement, after all, you’ve earned it!